Trader A: "I've been looking at this reverse convertible investment. The higher interest sounds appealing, but I'm a bit concerned about potential losses."

Trader B: "I see where you're coming from. Think of it like this: when you buy a reverse convertible, it's like getting a combo deal of interest payments and a stock bet."

Trader A: "Hmm, okay. So if the stock does well or stays stable, I get the interest and maybe some gains?"

Trader B: "Exactly! It's like enjoying the best of both worlds. But here's the catch: if the stock takes a big hit, you might end up with that stock instead of your money back."

Trader A: "Oh, that's a risk. So, how can I manage that?"

Trader B:"You can use a trick called 'hedging.' It's like buying insurance for your investment. You can get something called a put option, which gives you the right to sell the stock at a fixed price."

Trader A: "Interesting. So, if the stock tanks, I can sell it at that fixed price and minimize my losses?"

Trader B: "You got it! It's a safety net. But remember, while a reverse convertible can offer good returns and some protection, there's still a chance you might not fully benefit from big gains."

Trader A: "Gotcha. So, it's about finding the balance between earning more and protecting myself?"

Trader B:"Exactly! It's like enjoying the thrill of potential gains while having a backup plan if things don't go as expected."

Trader A:"Thanks for breaking it down. I'll need to think about whether the potential rewards outweigh the risks for my own situation."

Reverse convertibles work similarly to structured products, typically requiring a $1,000 initial investment. They have maturity dates spanning three months to one year. The "coupon rate" (interest) in reverse convertibles is usually higher than comparable conventional debt instruments from the same issuer.

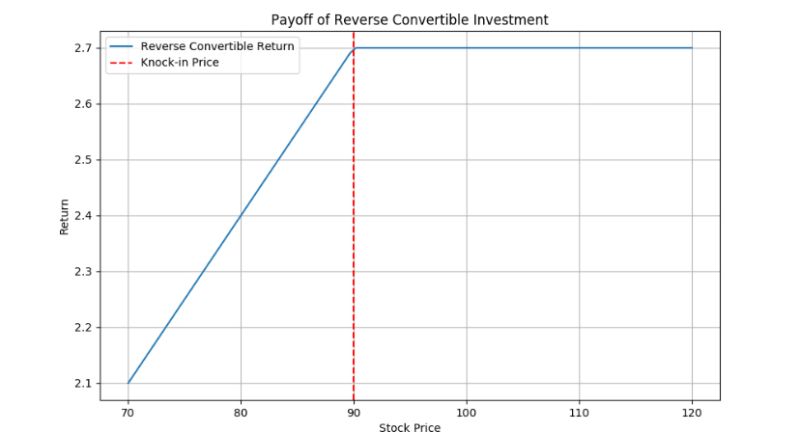

If a single stock reference asset drops in value but doesn't go below the "knock-in" price, a reverse convertible provides conditional downside protection unavailable with only the stock. However, this protection means sacrificing the chance for stock growth.

Based on stock performance, you'll either receive your principal in cash or a reduced number of stock shares if its price drops. Generally, if the asset stays above the knock-in level you'll get your full principal in cash.

Sometimes you'll get full principal return if the reference asset ends above the knock-in level at maturity, even if it dropped during the term. Breach of the knock-in level might result in receiving less than the original principal (short put payoff you can mitigate with a long put on the underlying).

It's important to note that reverse convertibles have capped gains. Even if the underlying stock's value experiences significant growth, the return you receive from a reverse convertible is typically limited to the coupon rate or interest offered by the investment.

#StructuredProducts #ReverseConvertible

Écrire commentaire