K-Means clustering in layman’s terms…

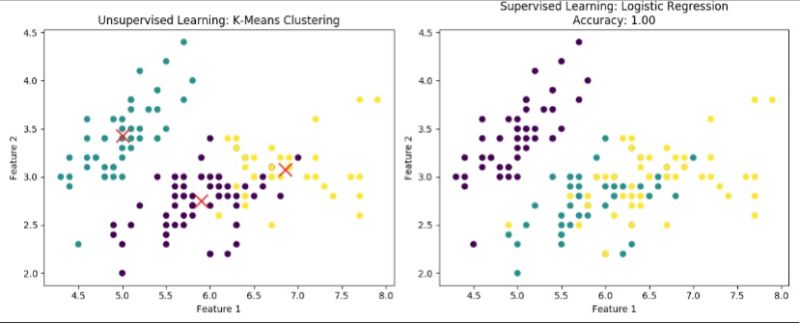

K-Means clustering is an unsupervised machine learning technique that's like organizing a collection of objects into different groups based on their similarities. Imagine you have a pile of various fruits, and you want to group them based on their characteristics. K-Means does something similar with data points, helping to find hidden patterns and associations.

Here's how K-Means works:

1. Starting Points: You pick a number, let's call it K, which is the number of groups you want to create. These groups are called clusters.

2. Finding Similarities: The algorithm then starts looking at your data points and calculates the "distance" between them. This distance helps measure how similar or different two data points are.

3. Grouping: K-Means starts placing data points into the clusters. It's like sorting the fruits into different baskets based on their similarities. Each basket represents a cluster.

4. Adjusting: The algorithm then figures out the center of each cluster, sort of like finding the average or "center point" of the fruits in each basket.

5. Repeating: K-Means keeps adjusting the clusters and their centers to make sure data points are in the right groups. This part is done over and over until the clusters don't change much or until a certain number of tries.

When K-Means stops adjusting, each data point is in a specific cluster. It's like all the fruits are neatly organized into baskets that have similar fruits.

K-Means helps to find groups in data without knowing beforehand what those groups should be. This can be super useful in finance:

1. Customer Groups: In finance, you can group customers based on their spending habits or investment preferences. This helps create better-targeted services.

2. Investment Categories: Stocks or assets that behave similarly can be grouped together. It's like creating baskets of related investments for better decision-making.

3. Risk Assessment: K-Means can help classify borrowers based on their credit profiles, making lending decisions more informed.

4. Trading Insights: Traders can use K-Means to spot patterns in market data and develop strategies based on similar behaviors.

5. Portfolio Optimization: By grouping assets with similar characteristics, you can optimize portfolios for better returns and risk management.

6. Market Insights: K-Means can reveal hidden trends in data that humans might miss, helping in decision-making.

In a nutshell, K-Means clustering is like organizing data into groups that have something in common, making it a valuable tool in finance for better understanding data, making predictions, and improving strategies.

#KMeansClustering #UnsupervisedLearning #DataAnalysis#MachineLearning #FinanceInsights #CustomerSegmentation#MarketSegmentation #CreditRisk #TradingStrategies#PortfolioOptimization #DataPatterns #FinancialAnalytics

Act

Write a comment