Imagine owning a new Tesla equipped with an exceptional speed regulator. Unlike traditional cruise control, which only keeps the speed consistent, this advanced regulator ensures both your speed and acceleration remain constant. To understand how this mirrors gamma neutrality in trading, let's break it down:

- Delta represents the speed of your Tesla. It mirrors how quickly an option's price moves relative to the underlying asset.

- Gamma stands for acceleration. It tells us how that speed (delta) evolves. Positive gamma signifies an increasing speed, while negative gamma indicates a decline.

By striving for gamma neutrality, it's like activating your Tesla's regulator. The goal is to maintain a consistent speed (delta) and ensure the acceleration (gamma) remains zero, offering a predictable drive.

When investing in a call or put option, you gain when the underlying asset's price moves favorably. This is your "delta" or "speed". But, the sensitivity of this speed to price changes, especially for options right at the brink of being in or out of the money, is your "gamma" or "acceleration".

Being long on such an option is like driving your Tesla up a steep incline. Here, even minor pressure on the accelerator leads to significant speed shifts. The more the underlying asset's price moves, the more pronounced this "speed" becomes, and this reactivity is the essence of gamma.

For investors, it's crucial to manage gamma to maintain a stable portfolio, akin to desiring a smooth drive. How do they do this? Through various strategies:

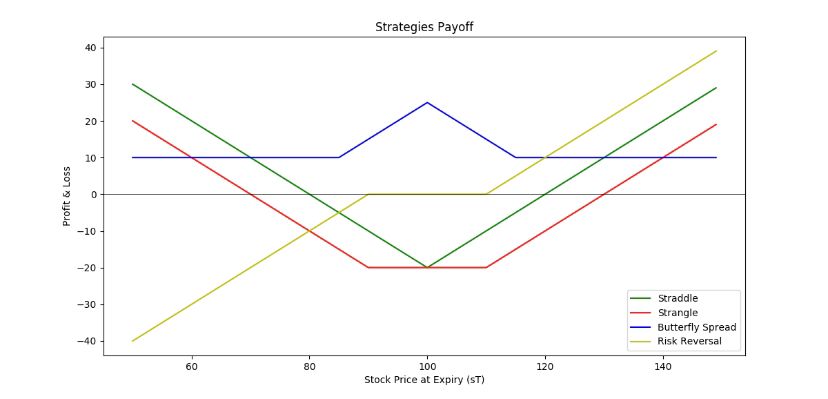

1. Straddle vs. Strangle: Banks might offset the high gamma of a straddle by combining it with a strangle, which has a low gamma.

2. Delta-Hedged Option: A strategy where, after selling a call option, banks buy the underlying asset to counteract the negative gamma. This hedge is adjusted over time based on price movements.

3. Butterfly Spread: This method involves balancing the high gamma of two at-the-money options by purchasing both an in-the-money and out-of-the-money option.

4. Structured Products: Custom products blend different options or derivatives, often achieving gamma neutrality.

5. Diverse Portfolio: By holding a varied mix of options, banks can balance out gamma exposure across the portfolio.

6. Risk Reversal: Mainly a skew strategy, when executed with specific conditions, it can be relatively gamma-neutral.

In essence, just as Tesla's regulator ensures a steady drive, gamma neutrality aims for a balanced portfolio. It helps in navigating the ever-fluctuating financial markets, ensuring the ride remains as smooth as possible.

#MarketAnalogies #OptionsTrading

Write a comment