- Accueil

- Home

- Training Catalog-2023

- Training courses

- MISSION EXAMPLES

- CONTACT

- Blog

- I. Stochastic Models and Processes

- II. Mathematical Tools and Principles

- III. Quantitative Finance Applications

- IV. Advanced Concepts and Theories

- V. Technical Methods and Interpolations

- VI. Miscellaneous Quant Topics

- VIII. Quant Interview Questions

- VII. Data Science and Technology in Finance

- Behavorial finance

- Corporate finance

- Quizzes

- Webinars

- The Layman’s Quant Lexicon

II. Mathematical Tools and Principles · 09. November 2023

An SPD matrix, with only non-negative eigenvalues, represents systems free from "negative energy" and ensures non-negative outcomes in various applications, including finance. It guarantees that any real vector, when applied to a quadratic form like portfolio variance, yields a non-negative result. SPD matrices are key in constructing risk models, pricing options, and in stochastic calculus, providing a reliable framework for financial analysis, optimization, and derivatives pricing.

II. Mathematical Tools and Principles · 09. November 2023

In quant finance, eigenvalues and eigenvectors distill risk and trends in portfolio analysis. They're crucial in PCA, reducing complex asset return data to key risk factors. For instance, eigenvectors direct to axes showing variance, while eigenvalues quantify it, revealing how assets move together.

#EigenvaluesInFinance #EigenvectorsExplained #PrincipalComponentAnalysis #CovarianceMatrix

II. Mathematical Tools and Principles · 01. November 2023

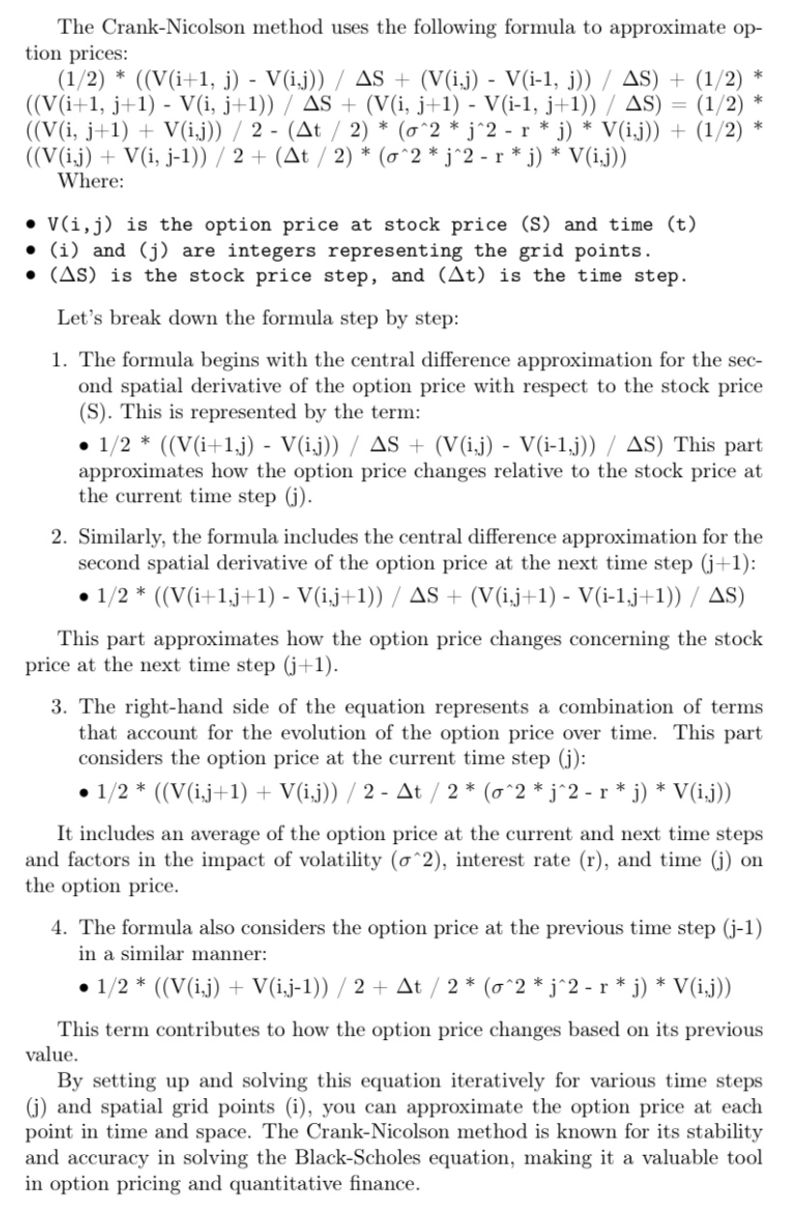

The Crank-Nicolson Method, pivotal in quantitative finance, adeptly solves PDEs for option pricing and interest rate modeling. It splits time and space into grids, balancing calculations between current and next steps (implicit and explicit). It's stable and precise, essential for real-world financial scenarios.

II. Mathematical Tools and Principles · 01. November 2023

The Jacobi method is a mathematical algorithm used to simplify complex matrices into a form that's easier to analyze, often for assessing risks and relationships in financial portfolios.

II. Mathematical Tools and Principles · 02. October 2023

Linear algebra simplifies complex finance puzzles, offering tools to optimize investments and manage risks. It uses matrices to express relationships between assets, enabling informed decisions to maximize returns while minimizing risk. Essential for quantitative finance.

II. Mathematical Tools and Principles · 02. October 2023

Analytical methods offer exact solutions via mathematical formulas, ideal for simpler problems. E.g., Black-Scholes Model for option pricing. Numerical methods, like Monte Carlo simulations, provide approximate solutions for complex, real-world problems, but can be computationally intensive.

II. Mathematical Tools and Principles · 24. September 2023

Unlock portfolio risk management with linear algebra & copula in layman’s terms. Master the art of pairs trading & optimize your asset allocation using easy steps. Dive into expected returns, covariance & portfolio weights. Mobile-friendly, updated insights! #FinanceEducation #RiskAnalysis

II. Mathematical Tools and Principles · 25. March 2023

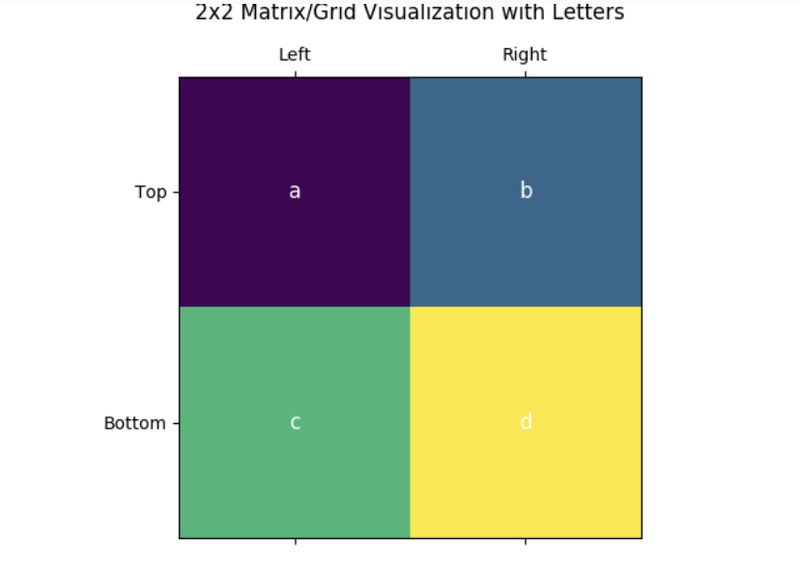

When trying to grasp the determinant of a matrix, envision a 2x2 grid, with values 'a' to 'd'. Picture it as arrows on a surface. The first column points as (a,c) and the second as (b,d). They form a slanted rectangle, a parallelogram. The formula 'ad - bc' signifies this shape's area. If negative, imagine viewing the shape from the opposite side. In essence, the determinant measures the space this shape occupies. Think of it as the "area" of the matrix's influence #MatrixDeterminant #MathBasic

II. Mathematical Tools and Principles · 18. March 2023

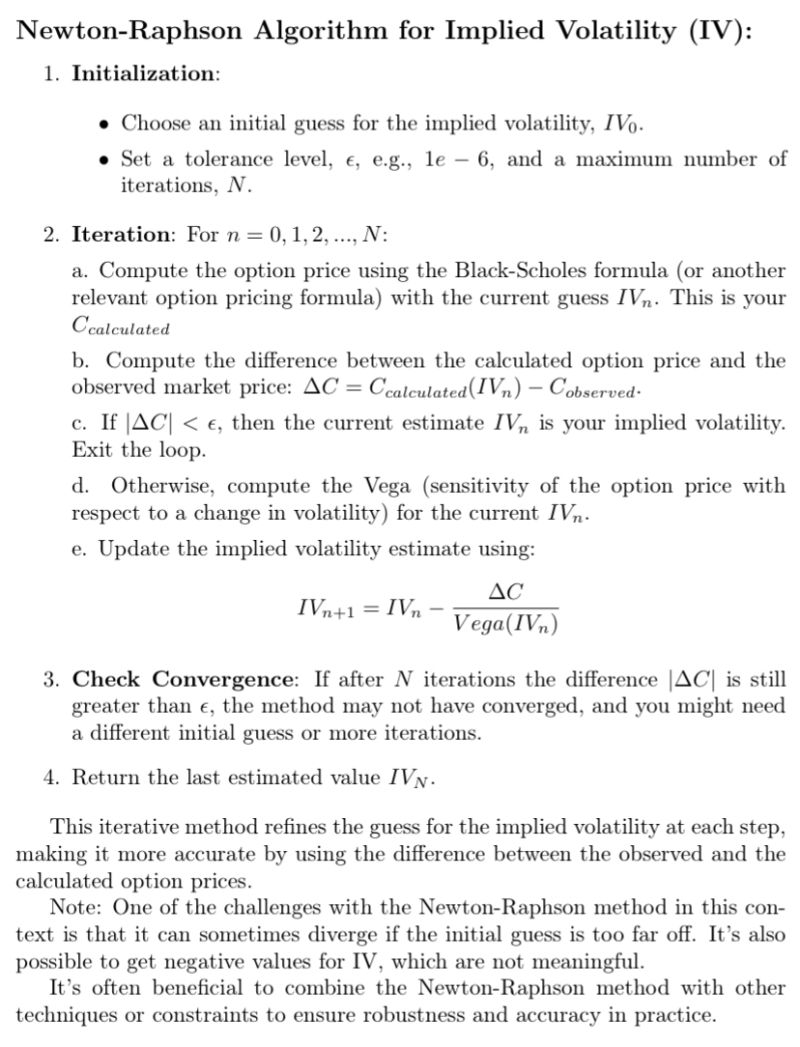

Meet Alex, a derivatives trader at a major bank. Lately, the stock market has been fluctuating due to global events. Alex comes across a European put option on stock XYZ trading for $15. The stock itself is currently priced at $100, the option's strike price is $100, and it matures in a year. The generally accepted risk-free rate is 5%. Alex believes this put option might be overpriced. His theory is that even though the market is currently volatile, it might stabilize over the coming year. To...

II. Mathematical Tools and Principles · 25. February 2023

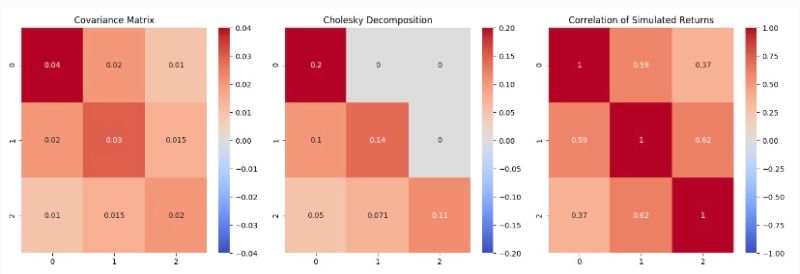

Cholesky decomposition, in essence, breaks down complex financial data to simplify understanding of risk interplay between assets. Picture this as disassembling a LEGO house to discern how each block contributes to its stability. In finance, this "deconstruction" reveals correlations in asset portfolios. By identifying these foundational risk relationships, professionals can navigate market complexities more adeptly, akin to understanding the best LEGO block placements for a sturdy structure.